Customizing Billing > Special Firm Settings > Interest and Reminder Statements

Interest and Reminder Statements

Interest and Reminder Statements

To control the application of interest and use of Reminder Statements for the firm:

-

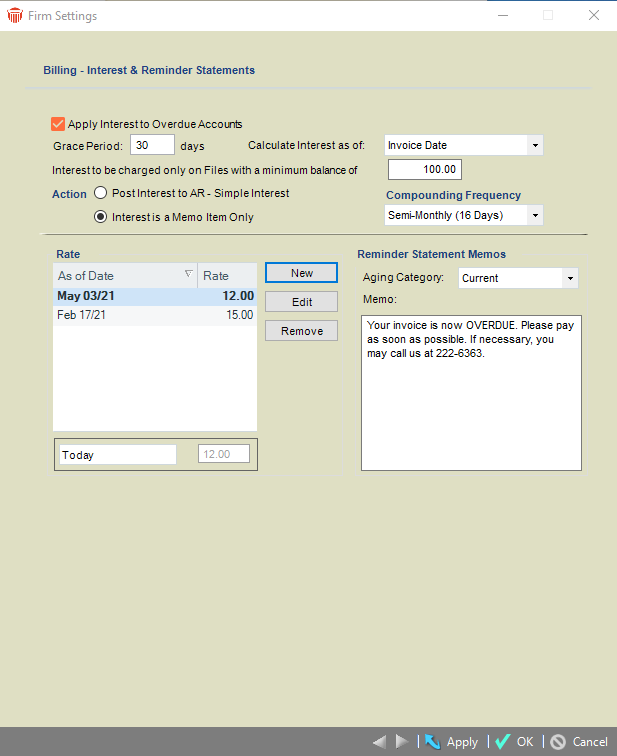

Choose Office > Firm Settings, and click Interest & Reminder Statements under the Billing heading.

-

Choose from the following options:

-

General options for interest and Reminder Statements.

-

Specify a Grace Period and threshold AR balance for posting interest and creating mass Reminder Statements.

-

Specify the Grace Period (number of calendar days following the AR Date of a Bill). Interest will not be posted for an unpaid Bill until the Grace Period is over. Nor will a mass Reminder Statement be generated.

-

Specify the minimum AR balance that a File must have in order that it be included in mass Reminder Statements. This is also the minimum balance that the File must have in order that interest be charged in Mass Billing or when generating mass Reminder Statements. For a Primary Client who is marked for Consolidated Billing, this minimum refers to the total AR balance of the Files that will be billed or included on their Statement.

-

|

Note: Options to send Reminder Statements and charge interest can be set on Bill Profiles, and overridden in individual Files. |

More interest options

-

Choose whether interest can be charged on Bills or when Reminder Statements are generated and, if so, set the following options:

-

For a Bill not fully paid by the end of the Grace Period, choose whether interest starts to accrue as of the Invoice Date or the end of the Grace Period.

-

-

Choose whether interest should be posted to AR or merely appear as a memo item on Bills and Reminder Statements. This affects interest charged from this point forward. If posting interest, only simple interest may be applied.

-

The stored Interest Rates are listed, the most recent first. For each Rate, the date that it applies and the annual percentage are shown. To create a new Rate, click New and enter information. Interest on an outstanding Bill is charged at the rate that corresponds to the AR date of the Bill.

-

Select the frequency with which interest is calculated: Simple, Compounded Monthly, Compounded Annually, etc. If you chose that interest should be posted to AR, only Simple interest may be used.

-

Simple interest is calculated as P x I x N, where:

P = principal amount (balance outstanding on Bill)

I = annual interest rate (as a decimal)

N = number of years -

For example, a Client has an outstanding Bill for $10,000 and the Interest Rate is 5%. If the Bill is 60 days overdue (calculated from the Invoice Date), then the interest is 10,000 x 0.05 x 60/365 = $82.19.

-

Compound Interest is calculated on the outstanding balance plus accrued interest, as P (1 + r/n)nt, where:

P = principal amount (balance outstanding on Bill)

r = annual nominal interest rate (as a decimal)

n = number of times interest is compounded per year

t = number of years -

For example, a Client has an outstanding Bill for $1,500, the Interest Rate is 10%, and the Compounding Frequency is Quarterly. If the Bill is 96 days overdue (calculated from the Invoice Date), then the interest is 1,500 (1 + 0.10/4) 4 x 96/365 = $39.48.

Reminder Statement memo

Related Topics