Customizing Billing > Special Firm Settings > Taxes

Taxes

Taxes

This topic covers:

Customizing Tax Settings

To customize Tax Settings for the firm:

-

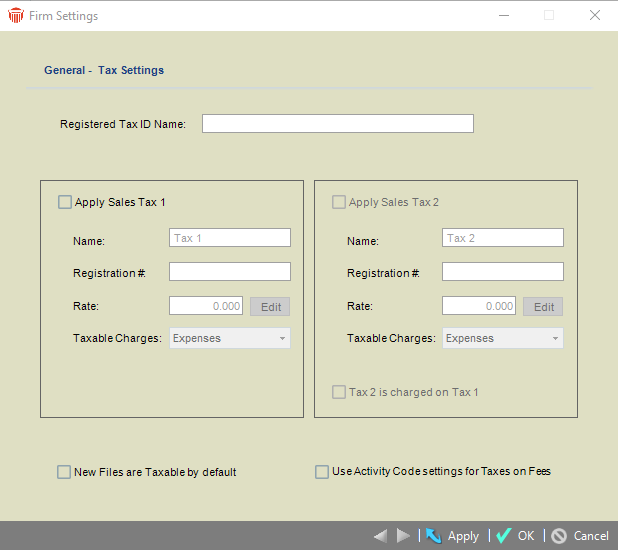

Go to the Firm Settings window and select Tax Settings under the General tab.

-

Enter the Registered Tax ID Name for the firm in the textbox.

-

Choose whether to apply Sales Tax to Client Bills and, if so, specify the Tax Name (label on screens and reports), Tax Registration Number (used when producing Bills), and Rates. Also choose whether the Tax is charged on Fees, Expenses, or both.

-

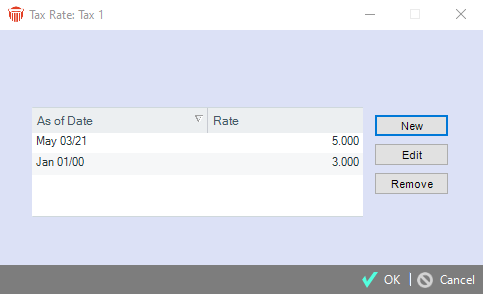

To specify a Tax Rate, click Edit next to the field. In the list of defined Rates, the date on which each Rate becomes effective and its percentage are shown. You can create new Rates, and edit and delete Rates.

-

Choose whether new Files are marked Taxable by default.

-

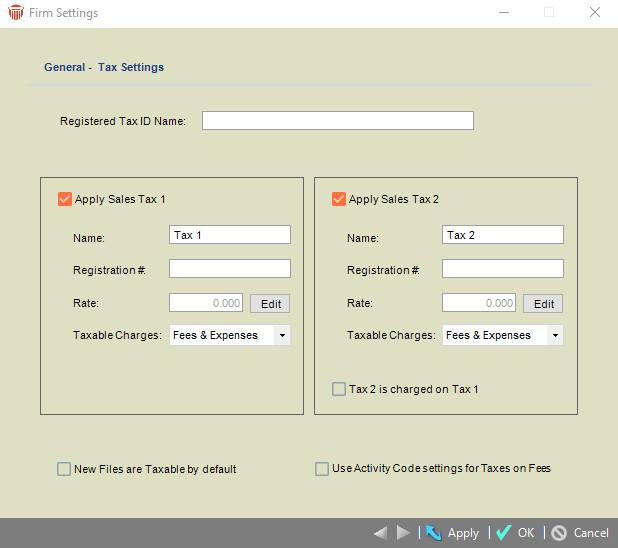

Choose whether to apply a second Sales Tax and, if so, specify its details. Choose whether this second Tax is charged on the first Tax rather than simply being charged separately.

Applying Taxes using Activity Codes

To apply taxes using Activity Codes:

- Go to the Firm Settings window and select Tax Settings under the General tab.

-

Select the For Tax on Fee use Activity Code settings checkbox and click OK or Apply to return to the Firm Settings window.

-

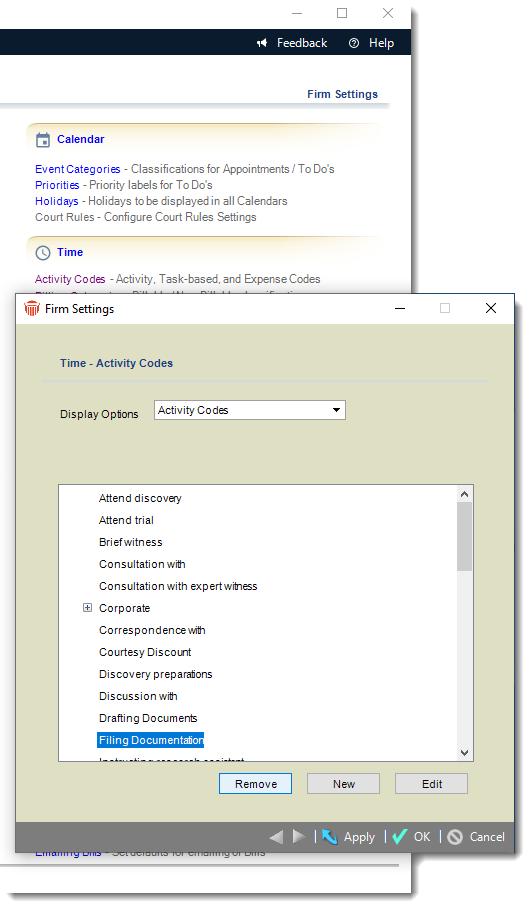

To define a taxable Activity Code, select Activity Codes under the Time tab.

-

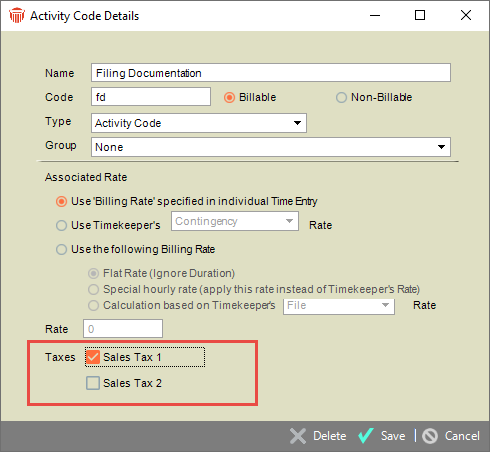

Select the Activity Code to charge tax from the list and click Edit to display the Activity Code Details dialog.

-

Select the appropriate tax type checkbox in the Taxes section and click Save.

-

When this option is selected, Amicus Billing calculates taxes on fees based on the activity code on the time entry.

Related Topics